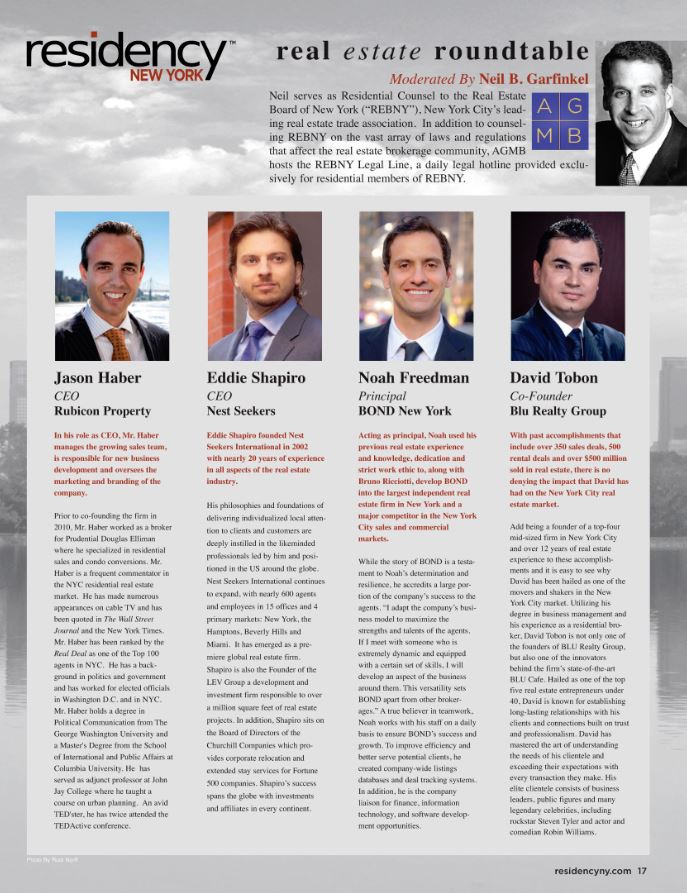

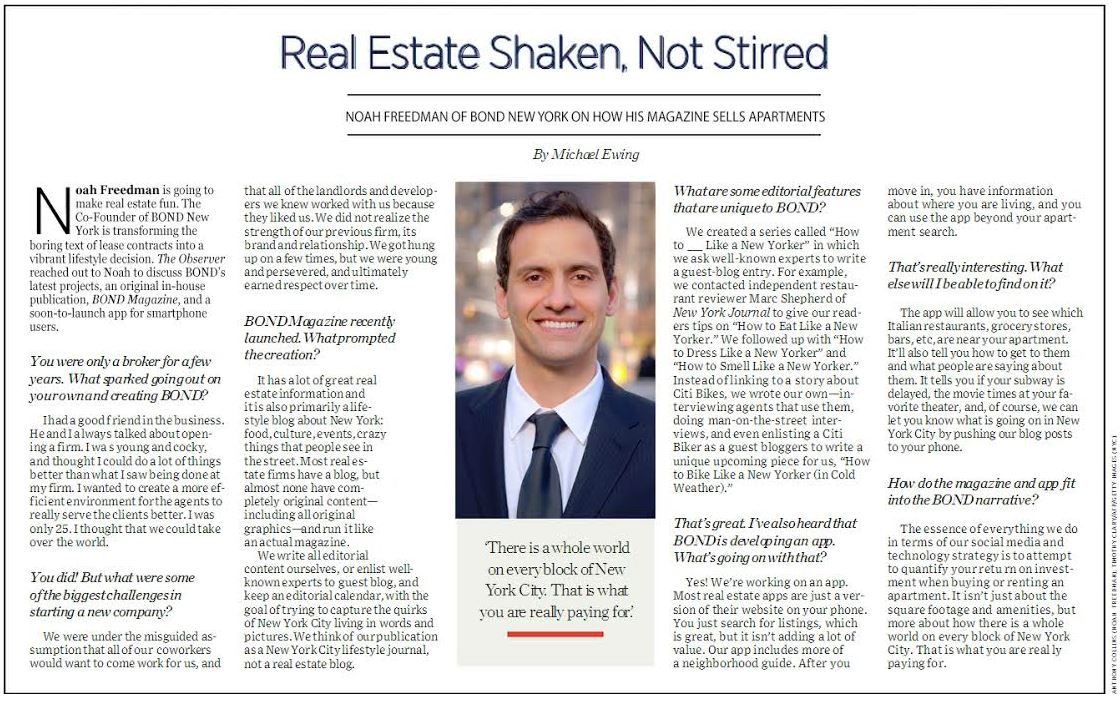

Noah Freedman

Principal Broker

After more than two decades in the real estate industry, Noah attributes all of his professional success to the following truism: “I am not afraid to fail.”

It is this fearless nature that inspired Noah and his co-founder Bruno Ricciotti to open their own brokerage firm in the fall of 2000, over 20 years ago. This decision would culminate into BOND NEW YORK.

Acting as principal, Noah used his previous real estate experience and knowledge, dedication, and strict work ethic to develop BOND into the largest independent full-service real estate firm in New York and a major force in the New York City rental/sales/commercial markets.

While the story of BOND is a testament to Noah’s determination and resilience, he accredits a large portion of the firm’s success to the agents.

“I adapt the company’s business model to maximize the strengths and talents of our agents. If I meet with someone who is extremely dynamic and equipped with a certain set of skills, I will develop an aspect of the business around them. This versatility sets BOND apart from other brokerages.… The people who work for you create an image and a brand more than anything else in this business, and that is priceless.”

A true believer in teamwork, Noah works closely with his staff on a daily basis to ensure BOND’s success and growth. To improve efficiency and better serve potential clients, he created proprietary company-wide listings databases and deal tracking systems. In addition, he is the company liaison for all marketing, advertising, finance, information technology, and software development opportunities as well.

In the next five years, Noah believes BOND NEW YORK will grow into the largest, most comprehensive real estate brokerage services company in the tri-state area. In the meantime, he continues to explore national and international real estate development opportunities.

-

95 CHRISTOPHER STREET, #12H

$6,4001 BR | 1 BT -

EAST 56TH STREET

$5,8502 BR | 1 BT -

No Fee

EAST 56TH STREET

$5,8502 BR | 1 BT -

No Fee

EAST 56TH STREET

$5,8502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT -

EAST 56TH STREET

$5,6502 BR | 1 BT - View All For Rent Listings

-

Rented No Fee

115 EAST 92ND STREET, #9AF

$13,7505 BR | 4 BT -

Rented No Fee

247 WEST 87TH STREET, #16B

$11,0003 BR | 2.5 BT -

Rented No Fee

111 EAST 80TH STREET, #3C

$8,9502 BR | 2.5 BT -

Rented No Fee

111 EAST 80TH STREET, #3C

$8,6502 BR | 2.5 BT -

Rented No Fee

247 WEST 87TH STREET, #4B

$8,6002 BR | 2 BT -

Rented No Fee

941 SECOND AVENUE, #5

$8,2954 BR | 2 BT -

Rented No Fee

301 EAST 47TH STREET, #4DE

$8,0953 BR | 3 BT -

Rented

FIRST AVENUE

$7,9954 BR | 1 BT -

Rented

145 EAST 16TH STREET, #18H

$7,8002 BR | 2 BT -

Rented No Fee

480 WEST BROADWAY, #2FL

$7,3502 BR | 1 BT -

Rented No Fee

13 EAST 7TH STREET, #34

$7,0002 BR | 2 BT -

Rented No Fee

25 WEST 68TH STREET, #3C

$7,0002 BR | 2 BT - View All Rented Listings

Real Estate Weekly

NYC's largest independently owned full-service real estate firm BOND New York celebrates 20 years of serving their clients in the greater New York Marketplace!

Click To View Original Article..The Real Deal

http://therealdeal.com/issues_articles/residential-scorecard-8/

The Real Deal - Residential Scorecard - May 1, 2016

Click To View Original Article..residencyNY

The Real Deal

Predicting 2014: Pros weigh in on everything from de Blasio to prices, but agree that market can’t keep up with last year’s pace

January 01, 2014

By Melissa Dehncke-McGill

New York Observer

Real Estate Broker's Insider

New York broker targets Chinese buyers

The New York Times

Unpaid Interns Enter the World of Real Estate - New York Times - February 6, 2012

http://www.nytimes.com/2012/02/07/nyregion/unpaid-interns-enter-the-world-of-real-estate.html?_r=2

Washington Square News

If you were planning to live off-campus this year, think again. According to Bond New York, New York City's largest growing, independently-owned residential brokerage, rent may soon become even more of a monetary burden.

Rent is expected to increase from 6 to 10 percent for current tenants and from 8 to 12 percent for new vacancies. On average, overall rent in Manhattan is expected to increase by 8 to 10 percent in 2012.

Based on a four-year study of Manhattan's rental market, Bond released a report predicting a rise in Manhattan rent prices in the coming year. The study drew its data from quarterly patterns in pricing since 2008 using statistics from Bentley, Bond's proprietary listings database.

The report shows Manhattan's rental market pricing progress from historic lows in 2009, as a result of the financial crisis, to its gradual push toward stability in 2010. In 2011 it surged to record highs, exceeding pre-financial crisis levels. From these trends, Bond concluded that prices would continue to rise in 2012.

"We weren't really surprised [with the results] because we have seen prices rise steadily over the year, so it's just a continuation of that trend," Bond agent Noah Freedman said.

Bond attributed the rent increase to the job market in New York City and to consumer confidence in one of the most expensive places to reside in the country.

"A continued robust job market in Manhattan [fuels] high demand for apartments throughout the city," Freedman said. "The broad perception among landlords is that more and more people will be coming to the city to work, which will push our already historically low vacancy rates to an even more critical mass."

However, Stern professor Stijn Van Nieuwerburgh said this expected rent increase might affect the relationship between not only residents and landlords, but also employers and employees.

"If this trend continues and this kind of rent increase, in fact, materializes, the city should allow for more construction of apartments to keep housing affordable for its residents and employers will have to pay more to keep attracting workers to New York City," he added.

Evelyn Cheng, a CAS sophomore who lives in her own apartment on 1st Avenue, expressed concerns for off-campus students.

"An increased rent will probably force me to move farther from campus or commute from Long Island because my family can't afford it," Cheng said.

Given the continuous trend of increasing prices, now may be the best time to get an apartment, according to Freedman.

"My best advice to a prospective tenant is to get an apartment sooner rather than later, if possible," he said. "[The] longer you wait, the more you will have to pay for your apartment."

The New York Post

Rents to rocket

Last Updated: 3:55 AM, January 13, 2012

Posted: 2:29 AM, January 13, 2012

New York landlords will be laughing their way to the bank in 2012.

Apartment rents are expected to skyrocket by as much as 12 percent by year’s end, according to a new report from the brokerage firm Bond New York.

Analysts predict that landlords will hike rents by 6 to 10 percent on current tenants and 8 to 12 percent on vacancies in 2012.

“Vacancies remain extremely low and landlords [are] offering very few incentives,” said Noah Freedman, founder of Bond, the largest independent brokerage in the city.

The wallet-sapping revelation comes the day after The Post reported that Manhattan residents were socked with an average 8.6 percent rent increase from 2010 to 2011.

Last year, the average monthly rent in Manhattan reached an eye-popping $3,309 — just one dollar short of the 2007 pre-crash record, according to another report released this week, from Citi Habitats.

That’s a big change from the way things were going following the 2008 economic crash, when savvy apartment hunters negotiated cheaper rents and nabbed incentives like one or two months of free rent. Some even snagged gratis gym memberships.

Read more: http://www.nypost.com/p/news/local/rents_to_rocket_oPuEkZS0TtYVCLpVIy7QsI#ixzz1jLvDS4Uv

Real Estate Broker's Insider

![]()